CitiAlerts

SMS and email notifications that help you keep track of your finances.

CitiAlerts have been created to ensure safety of your transactions and help you stay in full control of your finances.

With CitiAlerts you receive updates via SMS or email regarding your personal account or credit card activities.

- CitiAlerts are sent:

- once a day (account balance, transaction completion) or

- on an ongoing basis immediately after each card payment or cash withdrawal, except for PayPass transactions made using your credit card that are called offline transactions – offline authorization takes place without contacting the bank; once these transactions have been posted into your account you will receive your account balance update.

- CitiAlerts come in two packages that vary in terms of the scope of updated information and frequency of sending the updates.

- Activate CitiAlerts in Citibank Online.

| Notification type | Short description |

|---|---|

| Change in your Citibank Personal Account balance (notification on your account activity) | Notification is sent once a day, from Tuesday to Saturday, if there was a change in the account balance on the previous day. The message contains information on your account number, date on which your balance changed, current balance and available credit limit. |

| Uncompleted transaction in your Citibank Personal Account (notification on your account activity) | Notification is sent once a day, from Tuesday to Saturday, on the next working day following the non-completion of standing order or transfer with future date. The message contains information on your account number, date of transaction, Transaction/transfer amount. |

| Exceeding your Citibank Personal Account balance (notifications on your account activity) | Notification is sent once a day, from Tuesday to Saturday, on the next working day following the day on which your balance was exceeded. The message contains information on your account number, date on which your balance was exceeded, the amount by which your account was exceeded. |

| Your Citibank Credit Card balance (notification on your credit card activity) | Notification is sent once a day, from Tuesday to Saturday, on the next working day following the day on which your balance changed. The message contains information on your account balance and your available Citibank Credit Card limit as of the day on which the message was sent. |

| Repayment date (Cittibank Credit Card) (credit card notification) | Notification is sent one day before the credit card balance repayment date. The message contains information on the minimum amount due for repayment. |

| Limit decrease – Citibank Credit Card (notification on your credit card activity) | Notification on reduction of your credit limit (e.g. On request of the customer). The message contains information on your previous and new Citibank Credit Card limit. |

| Notification type | Short description |

|---|---|

| Change in your account balance (notification on your account activity) | Notification is sent once a day, from Tuesday to Saturday, if there was a change in the account balance on the previous day. The message contains information on your account number, date on which your balance changed, current balance and available credit limit. |

| Completed account transaction order (notification on your account activity) | Notification is sent on the day on which the account is debited with the amount of the standing order or transfer with future date . The message contains account number, transfer date and amount. |

| Uncompleted account transaction order (notification on your account activity) | Notification is sent once a day, from Tuesday to Saturday, on the next working day following the non-completion of standing order or transfer with future date. The message contains information on your account number, date of transaction, Transaction/transfer amount. |

| Exceeding your Citibank Personal Account balance (notification on your account activity) | Notification is sent once a day, from Tuesday to Saturday, on the next working day following the day on which your balance was exceeded. The message contains information on your account number, date on which your balance was exceeded, the amount by which your account was exceeded. |

| Citibank Credit Card current balance (notification on your account activity) | Notification is sent once a day, from Tuesday to Saturday, on the next working day following the day on which your balance changed. The message contains information on your account balance and your available Citibank Credit Card limit as of the day on which the message was sent. |

| Debiting your Citibank Personal Account (immediate notification on account activity) | Notication sent immediately after your account has been debited; contains debited account number, debiting date and amount (it does not apply to fixed payments, transfers with future date and standing orders. |

| Debiting your Citibank Personal Account – non-cash transaction /non-Citi ATM (immediate notification on account activity) | Notication sent immediately after your account has been debited with a non-cash transaction; contains debited account number, debiting date and amount. |

| Crediting your Citibank Personal Account (immediate notification on account activity) | Notication sent immediately after your account has been credited; contains credited account number, crediting date and amount. |

| Time deposit maturity date (notification on account activity) | Notication sent one working day before your time deposit matures; contains deposit number, amount and maturity date. |

| Time deposit opening confirmation | Notication sent on the day of opening time deposit; contains deposit number, amount and maturity date. |

| Time deposit breaking confirmation | Notication sent on the day of breaking time deposit; contains deposit number, and amount. |

| Time deposit renewal (account notifications) | The notification is sent on the day of the deposit renewal and contains information on the deposit number, renewed deposit amount, (excluding interest), next renewal date. |

| Available balance – Citibank Credit Card (credit card notifications) | The notification is sent once a day from Tuesday to Saturday, on the next working day following the day on which the Citibank Credit Card Balance changed. It contains information on the account balance and the Citibank Credit Card limit as of the beginning of the notification day. |

| Your credit limit is nearly used – Citibank Credit Card (credit card notifications) | The notification is sent once a day from Tuesday to Saturday, on the next working day following the day on which the Citibank Credit Card balance exceeded 80% of the credit limit. It contains information on the credit card account balance and available credit limit. |

| Stateemnt notification – Citibank credit Card (credit card notifications) | The notification sent on the day of the statement. It contains information on the credit balance repayment, total debt balance amount, minimum amount for repayment and available credit limit. |

| Credit balance repayment – Citibank credit Card (credit card notifications) | The notification is sent 1 working day before the credit balance repayment date. It contains information on the minimum amount for repayment. |

| Limit decrease – Citibank credit Card (credit card notifications) | Credit card limit decrease information (upon request of the client) containing information on the previous and new Citibank Credit Card limit. |

| Citibank Credit Card Debiting (immediate credit card notifications) | The notification is sent immediately after the Citibank Credit Card transaction is made (except for contactless transactions called the offline transactions where the authorization takes place without contacting the bank) and contains onformation on: transaction amount, available credit card limit (the information is sent also if the funds are blocked in the account) - regular payments, funds transfer with future date and standing orders do not generate such notifications). ). |

CitiAlerts Activation in Citibank Online

« back step 1 out of 4 next »Log on to Citibank Online. If you are not a Citibank Online user yet, please register using your debit/credit/identification card and 4-digit ATM PIN.

To activate the service, please select CitiAlerts from the top menu.

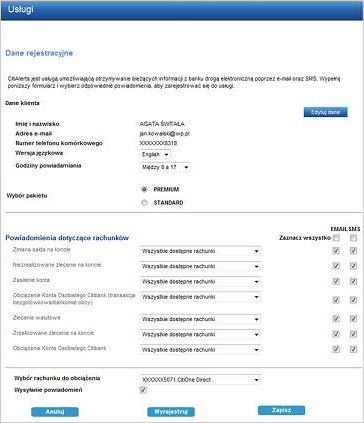

Fill out the registration form. The "Notification Sending" option activates the service. If you uncheck the "Description Display" option, you will see the full descriptions of each individual notification on the next screen. To continue, please click "Notifications".

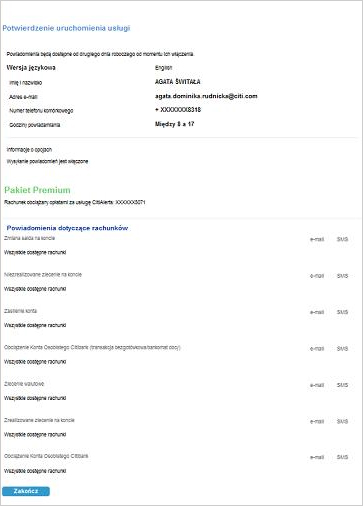

Check the details and the service options. If they are correct, click "Submit". The service will be activated within two working days following the registration. Please remember that you can change the settings any time.

Yes, you can. CitiAlerts is for both our credit card and personal account customers. If you use both products, you can choose to receive CitiAlerts for each of them.

The monthly CitiAlerts fee is PLN 6 for Standard Package.

Yes, you can. You can receive CitiAlerts for your one or all accounts, e.g. if you have three personal accounts with us and you want to receive your account balance updates, you have to choose one or all of your accounts – you can’t indicate just two of them.

No matter for how many accounts you receive CitiAlerts, you pay only one fee: PLN 6 for Standard Package and PLN 10 for Premium package.

The easiest and fastest way to activate CitiAlerts is via Citibank Online. Check it out. CitiAlerts can be also activated via CitiPhone or in Citi Handlowy branch.

During the registration process, you choose the time periods in which you will receive SMS updates. The time slots available are 8:00 am – 5:00 pm, 9:00 am – 10:00 pm, 18 pm-09 pm.

Yes, you can choose only way of receiving the notifications.

CitiAlerts fee is charged along with all other banking fees and charges.

Yes, they can. You only need to choose the proper type of notification. The credit card repayment date notification is available in both, Standard and Premium package.

You can resign from CitiAlerts via Citibank Online by selecting “Cancel” in the “CitiAlerts” section. Resignation from the service is free of charge.

You can receive CitiAlerts updates once a day or immediately after each change in your account balance. For more details, click here.

The packages vary in terms of the scope of notifications and frequency of sending them. Standard Package includes basic notifications on your accounts. Premium Package you can receive additional notifications, e.g. on your time deposits. Additionally, if you sign up for Premium Package, you can receive notifications immediately after a change in your accounts. For more information, see here.

CitiAlerts will be activated within 2 days following the registration.

You can update your contact details any time. The easiest way is to do it via Citibank Online in CitiAlerts section. You can also change your contact details via CitiPhone or in branch.