News archive

IMPORTANT SECURITY INFORMATION!

In recent weeks, we have seen an increase in the activity of criminals using social engineering to effectively withdraw funds from bank accounts.

We want to draw your attention to the following methods in particular:

- Impersonating another sender (compromised e-mail address) - criminals use a similarity of characters (e.g. the letter "o" replaces the 0), which can be difficult to detect or use an alias (display name of the e-mail address) for a particular address. (alias: Financial Director's Office \ [firmaabc@poczta.com]). In this way, criminals exploit the inattention of the customer's employees to enforce a specific action, such as the execution of an urgent transfer.

- Fraud perpetrated by impersonating the Chief Financial Officer / President / Chief Accountant - a sociotechnical method that uses the authority of an important person in the company to enforce an urgent transfer through electronic banking systems. This is done either by email or by phone, for example by a phone call from a person impersonating the company President and shouting at the accountant demanding an urgent transfer.

- False invoices and account number changes - criminals exploit the fact that companies are increasingly exchanging invoices or account information by e-mail. Criminals send fabricated invoices containing account numbers belonging to them, rather than to the appropriate payee.

How to defend against such methods?

Particular attention should be paid to the transfers handling processes and circulation of documents in the company.

We recommend using the "callback" method, which is to call back the contractor, who is indicated in the letter, invoice or in an e-mail, using the contact information held by your company. A change of the counterparty's account should be backed up by an additional verification (e.g. telephone confirmation from the contractor, cover letter signed by the contractor's authorised representatives). Modification based on received email may result in loss of funds.

Electronic invoices (PDFs, images, scans) should always be verified for accuracy - especially the bank account. Any differences should be clarified with the counterparty to avoid sending payments to criminals' accounts.

Regular daily verification of bank accounts, statements and account transactions should be a permanent practice used by companies.

In the event of any suspicion of fraud, we recommend urgent contact with the bank to minimize the risk of loss of funds.

Important information about security!

Beware of fake e-mails impersonating the Ministry of Finance

Dear Customer,

We have observed another wave of phishing attempts aimed at electronic banking users.

Criminals impersonating the Ministry of Finance issue “a meeting invitation”, adding an attachment with an alleged proof of concealment of income. Opening documents from that attachment leads to infection of the user’s computer with malware and thus increases the risk of unauthorized access to the bank account.

On the official website of the Ministry of Finance we read as follows (translation from Polish):

Ministry of Finance warns about fake e-mails in which the author informs about “concealment of income” or “scheduled income control”. Please do not open the message or the attachment. The attachment contains malicious code. Please be warned and remain cautious!

The message can originate from addresses beginning with:

- Ministerstwo-Finansow@

- Administracja-Podatkowa@

If you receive such an e-mail, please:

- do not click on any links or attachments,

- remove the message and do not forward it to anyone,

- inform the IT/Security Department in your firm.

Best regards,

CitiDirect Team

Citi Handlowy

Bank Handlowy w Warszawie S.A.

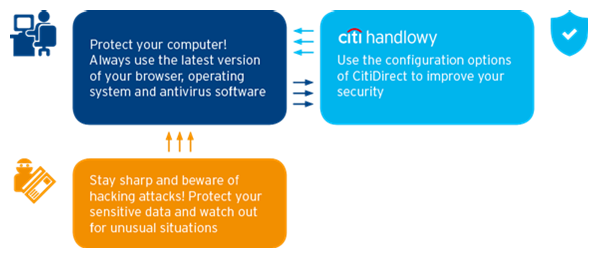

Protect your computer against attacks of malicious software!

We would like to remind you about the importance of safe use of electronic banking. CitiDirect is a secure banking system, however there exists a risk of a security breach on the side of the User’s computer or network. With regard to the above, please remember about a few rules to keep your funds even better protected.

Read more in the Security best practices