Documentation

This is to kindly inform you that the Bank Account Terms and Conditions and the Table of Fees and Charges will change effective March 1, 2017. The updated documents are available on the bank’s website in the Documents section.

This is to kindly inform you that the Citibank Credit Card Terms and Conditions of Bank Handlowy w Warszawie S.A. and the Table of Fees and Charges for Citibank Credit Cards will change effective December 15, 2016. The updated documents are available on the bank’s website in the Documents section.

Changes in cross-border transaction conversions - Frequently Asked Questions.

Starting 1 June 2015, the Credit Card transactions made abroad will be settled in 2 simple steps, which will make the whole process easy and transparent: - STEP 1: foreign currency conversion using the exchange rate of the Payment Company (VISA/MasterCard). - STEP 2: charging the Bank’s commission fee – 5.8% of the transaction value for all Credit Cards excluding Citibank MasterCard World Signia Ultime/Citibank World Elite MasterCard Ultime Credit Cards for which the commission fee will not be charged. This is a huge change compared to the previous way where the transactions, except for the transactions made in EUR, were converted twice with the Bank’s fee being included in the exchange rate applied to settle the transaction and with the additional fee being charged for transactions made outside of Europe. Now, you can clearly see what the amount of the commission fee is and when it is charged, which makes the whole process easy and simple. How it was: for transactions made in currency other than EUR or for transactions made outside of Europe (depending on the payment company) – two foreign currency conversions (one made by VISA/MasterCard payment company and the second one made by the Bank) and two fees: 4% of the exchange rate value – fee included in the exchange rate of the Bank + 1% of the EUR transaction value for transactions made outside of Europe. How it will be now: there will be only one foreign currency conversion using the exchange rate applied by the Payment Company (VISA/MasterCard) + one commission fee amounting to 5.8% of the transaction value.

Transactions made in a foreign currency will be converted to Polish zlotys using the exchange rate of the Payment Company. Then, there will be a commission fee amounting to 5.8% of the transaction value charged from the transaction amount in PLN. For transactions made with the Ultime credit card, the commission fee will be 0%.

This change aims to simplify the settlement of cross-border payments. Starting 1 June 2015, the Credit Card transactions made abroad will be settled in 2 simple and transparent steps: - STEP 1: foreign currency conversion using the exchange rate of the Payment Organization (VISA/MasterCard). - STEP 2: charging the Bank’s commission fee – 5.8% of the transaction value for all Credit Cards excluding Citibank MasterCard World Signia Ultime/Citibank World Elite MasterCard Ultime Credit Cards for which the commission fee will not be charged. This is a huge change compared to the previous way where the transactions, except for the transactions made in EUR, were translated twice with the Bank’s fee being included in the exchange rate applied to settle the transaction and with the additional fee being charged for transactions made outside of Europe. Now, you can clearly see what the amount of the commission fee is and when it is charged, which makes the whole process easy and simple. How it was: for transactions made in currency other than EUR or for transactions made outside of Europe (depending on the payment company) – two foreign currency conversions (one made by VISA/MasterCard payment company and the second one made by the Bank) and two fees: 4% of the exchange rate value – fee included in the exchange rate of the Bank + 1% of the EUR transaction value for transactions made outside of Europe. How it will be: there will be only one foreign currency conversion using the exchange rate applied by the Payment Organization (VISA/MasterCard) + one commission fee amounting to 5.8% of the transaction value.

In the current cross-border payment market model there are two fees applied – the foreign currency conversion fee and the spread/profit mark-up fee included in the exchange rate. Starting 1 June 2015, there will be no fee included in the exchange rate charged for Citibank Credit Cards.

For VISA credit cards, please use the calculator available on Visa International website, to find out the exchange rate that will be/was used to convert your transaction to Polish zlotys: a) click on the "Currency Converter" button b) in the "My Card Is In" field choose the settlement currency for your Visa card (PLN) c) in the "My Transaction Was In" field choose the currency in which your foreign transaction was made d) enter “0” in the "Enter Bank Fee" field (the fee is charged after the transaction has been converted to PLN) e) choose the transaction settlement date in the "Date Requested" field f) click "Calculate Exchange Rate" to see the Visa exchange rate for selected foreign currency. For MasterCard credit cards, please use the calculator available on MasterCard website – the exchange rate applied to convert the transaction from the original currency into Polish zlotys: a) click on the "Currency Converter" button b) choose the transaction settlement date in the "Settlement Date" field c) choose the currency in which your foreign transaction was made in the "Base Currency" field d) in the PLN item in the table below you will find the exchange rate applied to convert your transaction to PLN.

The transaction will be converted at the exchange rate of the Payment Company at the date when the Payment Company receives the transaction from the service provider. There is a possibility that the transaction will be converted at the exchange rate at a date other than the date of the transaction. This is affected by the following factors: time of transaction, type of transaction: online or offline, the latitude at which the transaction was made (time differences, cut-off times). The Bank cannot determine the date on which the exchange rate will be applied to convert the transaction, and cannot select the exchange rate.

If a cross-border transaction is made in PLN – it will not be re-converted. Such transaction is already converted when you select the currency in which you will make the payment. The rate applicable at this stage is the seller’s rate (it is not the Bank’s rate and may contain a margin). In such cases the transaction is treated by the Bank as a local transaction (no fee for currency conversion will be charged), despite the fact that the Bank incurs costs relating to charges on such cross-border transactions paid to Payment Companies.

In the case of any changes to the Agreement or its integral appendices (including the Terms and Conditions, Banking Fees and Charges Schedule), you can object to these changes, which will be tantamount to the termination of the Credit Card Agreement upon 30-day notice period but no later than on the day preceding the date when the proposed changes become effective. In such case, the you can also terminate the Credit Card Agreement without notice. You can submit such instruction in writing, by phone (via CitiPhone) or via Citibank Online.

The change in the method used to convert cross-border transactions is a considerable simplification that lets the customer determine the cost of their cross-border transactions in a simple way. The fee charged by the Bank is very clearly presented in the Banking Fees and Charges Schedule.

If you raise an objection to the changes in accordance with the Credit Cards Terms and Conditions, your Credit Card Agreement will expire on the day preceding the introduction of changes, at the latest. The objection will not provide an opportunity to continue the Agreement under the old Terms and Conditions.

The fee for currency conversion of a transaction made in a foreign currency other than PLN is not a new cost for the customer. To date, the customer has paid the currency conversion fee which was included in the exchange rate applicable to the conversion of the settlement currency and a fee on transactions made outside of Europe. Now, there will be one transparent fee that will replace two previous fees. In addition, one currency translation will be applied, and the exchange rate of the Payment Companies will be applied to convert amounts from the original currency to PLN.

In the case of cash transactions made abroad, the transaction will be converted at the exchange rate of the Payment Company into PLN and a conversion fee at 5.8% of the transaction value will be added to it. Since an ATM withdrawal is a cash transaction, a fee on cash transactions at 6% of the transaction value but no less than PLN 10, will also be charged.

Changes in the Table of Fees and Commissions that became effective January 1, 2015 – Frequently Asked Questions

Credit Card

On 1 January 2015, a PLN 6 monthly fee was introduced for the possibility to use CitiPhone by the customer. You may cancel the CitiPhone service and then no charge will be collected. You can do it via Citibank Online, in the “Contact us” section. Even if you cancel the CitiPhone service, you will still be able to use CitiPhone to activate your card/set up PIN as well as in emergencies such as reporting the card stolen or lost

The CitiPhone fee is charged once a month no matter how many primary/additional accounts you maintain with us.

No. The fee is not applied for the Ultime Credit Card holders even if they have also other Citi credit cards

Yes. If you used the CitiPhone service at least once per month, the fee will be charged.

Yes. The CitiPhone fee is applied separately to each product: - for Personal Account maintenance, the fee is taken from your account, - for Credit Card maintenance, the fee is taken from your Credit Card account.

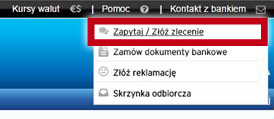

You can submit all requests/ enquiries/ instructions using the “Contact us” section in Citibank Online.

Yes. If your card has been cancelled and you can’t log on to Citibank Online, you can use CitiPhone free of charge.

No. Adding a beneficiary under this type of transfer remains free of charge, and you will not be charged any CitiPhone fee.

Yes. The CitiPhone fee is charged independently from your product account. Being eligible for using CitiPhone free of charge under your personal account does not release you from the CitiPhone fee for your Credit Card maintenance from your Credit Card account.

Yes. Our Consultant should advise you that the CitiPhone service is unavailable for this card account.

Yes. All telephone calls to the Automated Banker are free of charge.

Forms conversion Credit Cards:

Citibank Credit Card to Citibank PremierMiles Credit Card Change Form

Citibank Credit Card to Citibank MasterCard Credit Card Change Form

Citibank Credit Card to Citibank World MasterCard Credit Card Change Form

Citibank Credit Card to Citibank-BP Credit Card Change Form

Regulations:

Terms and conditions of special offer "Take more, pay less!"

Terms and Conditions of Citibank BP-PAYBACK Credit Card Program (effective from 1.01.2016)

Terms and Conditions of Citibank BP-PAYBACK Credit Card Program (effective till 31. 12.2015)

Terms and Conditions for PremierMiles Program valid to 30.04.2017

Terms and Conditions for PremierMiles Program valid from 30.04.2017

Credit Card Citibank – 50 pln voucher for shopping

Table of Fees and Commissions of the Citibank "Spend-get for Smart Branches across Poland"

Gold Citibank Credit Card in price Silver Citibank Credit Card

Table of Fees and Commissions "Switzerland"

Table of Fees and Commissions of the Citibank Credit Card Insurance Coverage

Table of Fees and Commissions of special offer for Citibank coustomers

Table of Fees and Commissions special offer Bonus for Credit Card in web

Table of Fees and Commissions special web offer " Year without any fees with Citibank Credit Card"

Table of Fees and Commissions special web offer " Year without any fees with Citibank Credit Card"

Table of Fees and Commissions of "100% discount for ZTM ticket"

Table of Fees and Commissions of "less expensive ticket Citibank Credit Card"

Rewards Catalogue for Citibank World MasterCard Credit Card effective from 16 December 2016

Terms and Conditions of Citibank World MasterCard Credit Card Program effective form 10 March 2016

Table of Fees and Commissions of program Citibank MasterCard World

Table of Fees and Commissions of loyalty program for Citibank Credit Card Student

Table of Fees and Commissions of Credit Card BP for Link4 TU S.A coustomers

Table of Fees and Commissions of clining promo Car Wash

Table of Fees and Commissions of promo in Wild Bean Cafe

Table of Fees and Commissions phone special offer

Other documents:

Terms and Conditions for PremierMiles Program valid from 1.12.2015

Insurance conditions security package valid untill 31.03.2015

General Terms and Conditions of CreditShield Insurance valid untill 31.03.2015

General Terms and Conditions of CreditShield Plus Insurance valid untill 31.03.2015

Scope of Insurance for Holders of Citibank Credit Card MasterCard World

Exercise Benefits Concierge Rules and Information

General Conditions of CreditShield Standard Insurance

General Conditions of CreditShield Premium Insurance

Fees & Commissions Table - Accounts and Overdrafts for Individual Clients - effective July 1st 2016.

Terms and Conditions of Bank Accounts – effective July 1st 2016

The attachment Rules of Payment Instruction Submission – effective November 1st 2016

Terms and Conditions of Bank Accounts – effective March 1st 2017

Interest Rates Table:

Table of Account Interest Rates - effective April 11th, 2016

Other documents and forms:

Information sheet for depositors

International sanctions - individual clients

Terms and Conditions of the Special Offer “Citi Priority Welcome Award!”

List of accepted Insurance Companies

Terms & Conditions of Mortgage Loan

Terms & Conditions of Insurance Coverage for Citibank Personal Account Holders

Terms & Conditions of Bank Accounts

Fees & Commissions Table - Home Equity Loan

Fees & Commissions Table - Mortgage Loan

Archive documents:

Terms and Conditions of “Safe Line” General Insurance

General Insurance Terms & Conditions: Old-Age Pensioners

General Insurance Terms & Conditions: Professionals

General Insurance Terms & Conditions: Employees

General Insurance Terms & Conditions of the “Safe Installments” Program for Borrowers under 65

General Insurance Terms & Conditions of the “Safe Installments” Program for 65+ Borrowers

Terms & Conditions of Cash Loan

Terms & Conditions of the “Your Loan - Your Benefits” Program

Insurance Products to Citibank Credit Cards.

Terms & Conditions of Insurance Coverage for Citibank Credit Card Holders

Terms & Conditions of the “Safety Package” Insurance

General Terms & Conditions of CreditShield Insurance

General Terms & Conditions of CreditShield Plus Insurance

General Conditions of CreditShield Standard Insurance

General Conditions of CreditShield Premium Insurance

CreditShield Standard Insurance Product Information

CreditShield Premium Insurance Product Information

“World Without Borders” Travel Insurance

Rules of Signing “World Without Borders” Insurance Agreements Online

“The World without Borders” travel insurance card

Steps to take in case of a loss

Safe Installments Loan Insurance

General Terms and Conditions of Safe Installment Payments

General Insurance Terms & Conditions of the “Safe Installments” Program for Borrowers under 65

General Insurance Terms & Conditions of the “Safe Installments” Program for 65+ Borrowers

Fees & Commissions Table: Accounts and Overdrafts for Individual Clients (effective July 1, 2016)

Terms & Conditions for Bank Accounts at Bank Handlowy w Warszawie S.A.

Terms & Conditions for Bank Accounts at Bank Handlowy w Warszawie S.A. – effective March 1st 2017

Statement of Withdrawal from a Citibank Overdraft Agreement

Information Form - Consumer Loan

Rules of Payment Instruction Submission – effective till October 31st 2016

Documents effective 30 April 2016

General Terms and Conditions of-co-operation with Corporate Client

Other Documents

Documents effective 30 April 2016

Citigold Business Offer - Fees and Commissions Table

Citi Priority Business Offer – Fees and Commissions Tables

Other Documents

Banking Fees and Charges for Business Credit Cards

Other Banking Fees and Charges no longer applicable, effective from 15 July 2014