What is ISO 20022?

ISO 20022 is a global, open communication standard for financial institutions established by the International Organization for Standardization (ISO), an independent, non-governmental standardization body. It is a language based on a business dictionary, which harmonizes multiple scattered standards.

ISO 20022:

- includes a lot of highly structured data, which is substantially beneficial to all market participants;

- enhances data sets by promoting a comprehensive automation throughout the entire lifecycle of a transaction;

- improves abilities of automatic readout, thus enabling faster processing and greater compatibility between different countries and clearing systems.

Both banks and their clients have to upgrade their systems to comply with the new requirements.

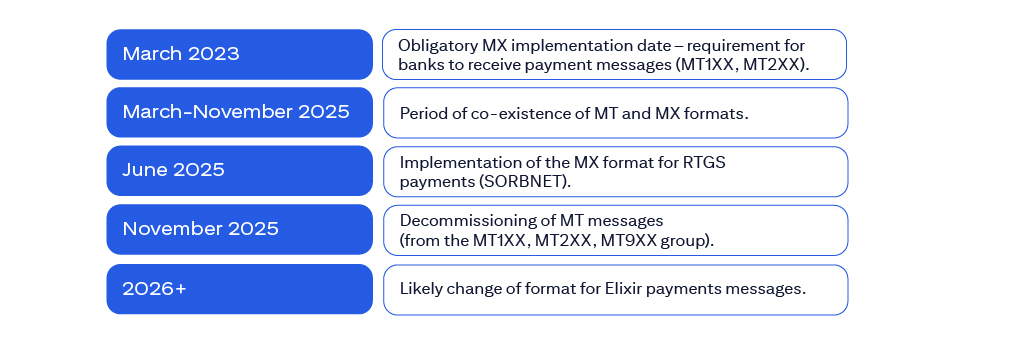

What is the ISO 20022 system migration timeline according to SWIFT?

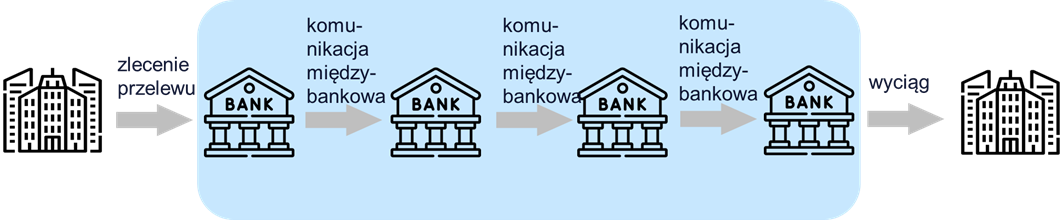

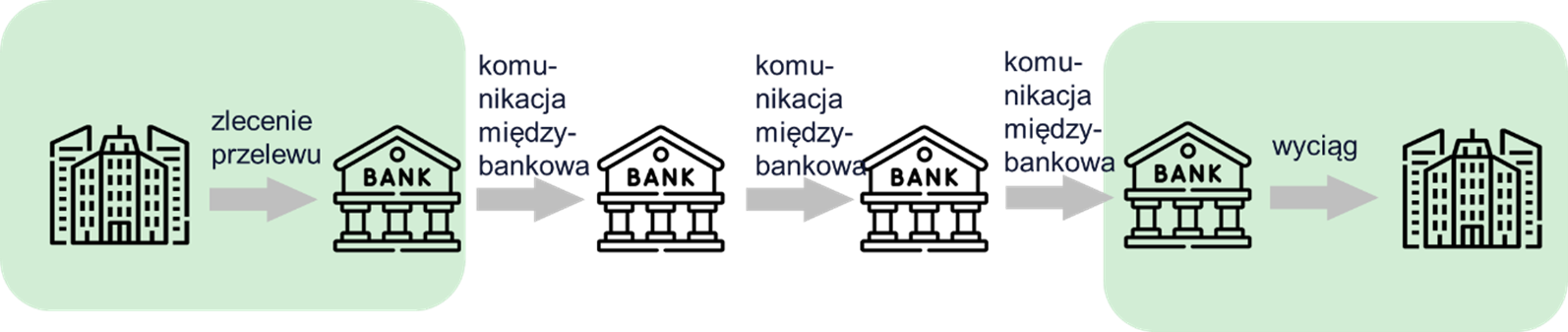

Transition to the ISO 20022 standard is primarily about communication (information exchange) between banks:

- until 2023, banks sent messages to each other in MT format (e.g. MT103),

- from 2023 on, banks continue to send messages in MT format to each other, but they can also send messages in the new MX format, i.e. in a format compliant with the ISO 20022 standard (e.g. pacs.008). A bank is required to accept an MX message if another bank sends it, but it is not required to send them. During this transitional period, Citi Handlowy continues to send messages in MT format and will support them until November 2025,

- starting from November 2025, key payment messages (MT1XX, MT2XX) should be sent between banks as MX messages only.

- until September 2025, banks will send messages to each other in MT format (e.g. MT103),

- from September 2025, banks will only exchange MX messages with each other.

- currently, banks send messages to each other according to the rules agreed for a given system,

- there are no specific dates yet for the migration of systems other than SORBNET to the ISO 20022 standard. In particular, for the Elixir system, we expect it to be 2026 or later.

Timeline of changes:

-

New version of MX for SEPA

March 2024 – adaptation of SEPA messages to the latest xml version

November 2026 – implementation of a new standard in line with ISO 20022 (including structured addresses)

The transition of interbank communication to the ISO 20022 standard will also affect communication between a bank and its clients – both for submitting transfer orders and for downloading statements:

Communication between a bank and a client is influenced by many variables, such as:

- the method (channel) of ordering a transfer/receiving a statement (this may be a transfer form filled in in an electronic banking system/a statement downloaded from the bank's system, an import file according to the bank's technical specifications, or, for example, a SWIFT order sent/received via the SWIFTNet network),

- format of transferred data (e.g. transfer order: MT101 message in the MT/pain.001 standard, in the MX standard/message according to the bank's own template, etc.; a statement in MT940 format in the MT standard/camt.053 format in the MX standard/statement in accordance with the bank's own template, e.g. PDF, etc.).

Therefore, it is difficult to provide general migration rules and deadlines that apply to all clients of the bank, all channels and all file formats. As the work progresses, we will provide you with more detailed information specific to the data exchange scenario between your company and Citi Handlowy. However, we would like to draw your attention to several issues now:

- it is worth making preparations in terms of the quality of data used by you in transfers, especially when it comes to recipients' data, and especially their addresses. In the coming years, we can expect the introduction of the obligation to provide at least the city and country of the recipient in a structured form – it is worth preparing for this,

- if you are already ordering transfers as MX messages (pain.001), please remember that the systems that do not yet support this standard (here: Elixir, SORBNET until June 2025) only accept a limited scope of data,

- If you order transfers using the SWIFT network (SWIFTNet), you are also subject to the requirements imposed by the SWIFT network itself.

- we recommend that you replace statements in the MT940/942 format with the formats camt.053 and camt.052 as soon as possible, as these formats incorporate a wider scope of data provided by a counterparty.

- since the new MX messaging format includes additional fields that were not used in the MT format, bank statements can be expected to include more information,

- if you receive your statements using the SWIFT network (SWIFTNet), you are also subject to the requirements imposed by the SWIFT network itself.

MT messages to migrate to MX

The new format will be applicable to MT1XX, MT2XX, and MT9XX messages (both for payment messages and bank statements).

Which messages will be changed?

How will ISO 20022 affect our clients?

- The currently used standard, templates and transaction import files remain unchanged. At the same time, we are working to ensure that new formats in the future fully utilize the opportunities that ISO20022 will

We will inform you in advance of any changes.

- For now, you can still use MT messages.

However, taking into account the possibilities offered by the ISO20022 standard, in the form of a wider scope of data, it is worth considering if changes in the financial and accounting systems should be implemented right now with respect to ordering payments and receiving statements.

At the same time, as a bank, we are working to implement the ISO 20022 format and we will keep you updated about any changes.

- At the moment, you can still use MT101 and MT9XX messages. We will keep you updated on the dates and scope of planned changes.